Earlier rate increases strained their business by knocking down the value of loans and bonds bought when rates were ultra low. Microsoft and Nvidia were the two strongest forces pushing up the S&P 500, and each rose at least 1.4%.īanks gained ground on hopes for a halt to rate hikes. That includes big technology and other high-growth stocks. In the meantime, though, stocks that tend to benefit the most from lower interest rates are leading the way. That’s also why many investors say the waiting game is still on to see if one of the longest-predicted recessions in memory will actually happen. That means she expects rates to stay high for a while. “Despite today’s deceleration, we continue to expect inflation to remain above the Federal Reserve’s 2% target, making it unlikely that we see policy easing soon,” said Gargi Chaudhuri, head of iShares Investment Strategy, Americas. That’s what happened in March, when high rates helped cause the failure of three U.S. Rate hikes take a notoriously long time to filter through the system, and unanticipated pain can occur.

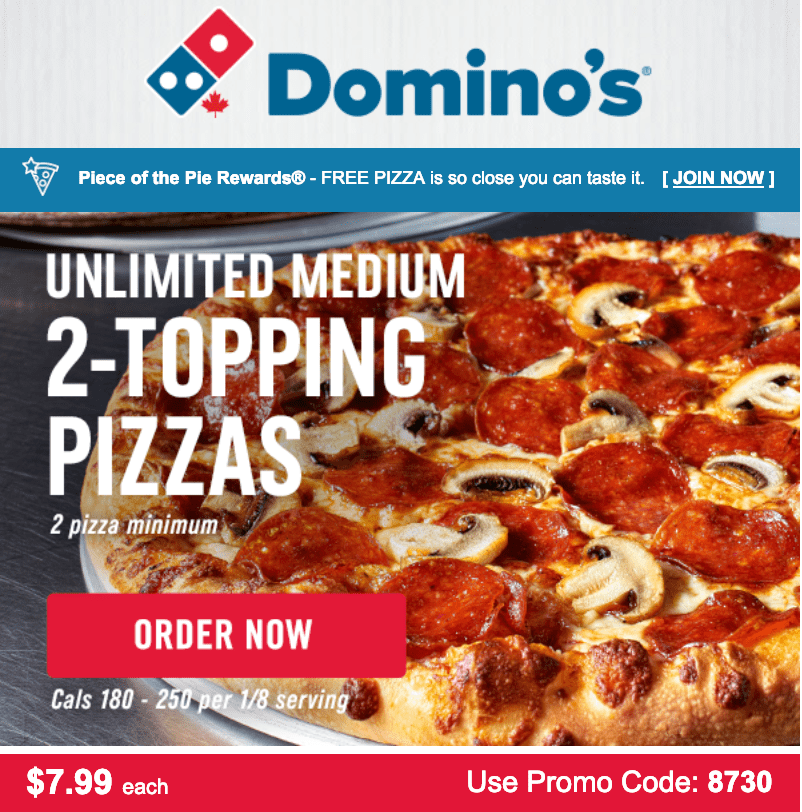

#Dominos pizza deals today in conway sc full

To be sure, even if the Fed does halt its hikes, analysts warn the economy and financial markets still haven’t seen the full effect of all the past increases. It tends to follow expectations for the Fed more closely. The two-year Treasury yield dropped to 4.74% from 4.89%. It helps set rates for mortgages and other important loans. The 10-year Treasury yield fell to 3.86% from 3.98% late Tuesday. Treasury yields tumbled in the bond market after the cooler inflation data pushed traders to trim bets for Fed action later this year. jobs growth, which could also take some pressure off inflation. He pointed to another report earlier this month that showed a slowdown in U.S.

“They’ll probably still pull the trigger on a hike, but it will be based on symbolism more than substance,” said Brian Jacobsen, chief economist at Annex Wealth Management. But expectations are also climbing for that to be the final increase after rates started last year at virtually zero. Traders remain nearly convinced the Fed will raise the federal funds rate at its meeting in two weeks to a range of 5.25% to 5.50%, which would be its highest level since 2001. Higher rates undercut inflation by slowing the entire economy and hurting investment prices, and they’ve already caused damage to the banking, manufacturing and other industries. High inflation has been at the center of Wall Street’s problems because it’s driven the Federal Reserve to jack up interest rates at a blistering pace. Perhaps more importantly, it was a touch lower than economists expected. That’s down from 4% inflation in May and a bit more than 9% last summer.

#Dominos pizza deals today in conway sc update

government’s latest update on inflation showed that consumers paid prices for gasoline, food and other items that were 3% higher overall in June than a year earlier. The rally was widespread, and everything climbed from stocks of flashy Big Tech behemoths to banks to staid utility companies. Eastern time, and the Nasdaq composite was 1% higher.

The Dow Jones Industrial Average was up 63 points, or 0.2%, at 34,401, as of 3:25 p.m. The S&P 500 was 0.7% higher in afternoon trading and was up more than 1% earlier in the morning. NEW YORK > Wall Street is rising today after a report showed inflation cooled a bit more than expected last month, which hopefully takes some more pressure off the economy. But analysts say they still expect rates to remain high for a while. Stocks were up even more earlier in the day on hopes for a coming halt to rate hikes. Treasury yields tumbled in the bond market as the cooler inflation data pushed traders to ratchet back bets for hikes to interest rates by the Federal Reserve later this year. The Dow added 86 points, or 0.3%, and the Nasdaq rose 1.2%. NEW YORK > Stocks closed higher on Wall Street after a report showed inflation cooled a bit more than expected last month.

0 kommentar(er)

0 kommentar(er)